Liquidation is the process in accounting by which a company is brought to an end in Canada United Kingdom United States Ireland Australia New Zealand Italy and many other countriesThe assets and property of the company are redistributed. 166 Directs the Board to prescribe early remediation requirements to address the financial distress of a Board-supervised nonbank financial company or a bank holding company with total consolidated.

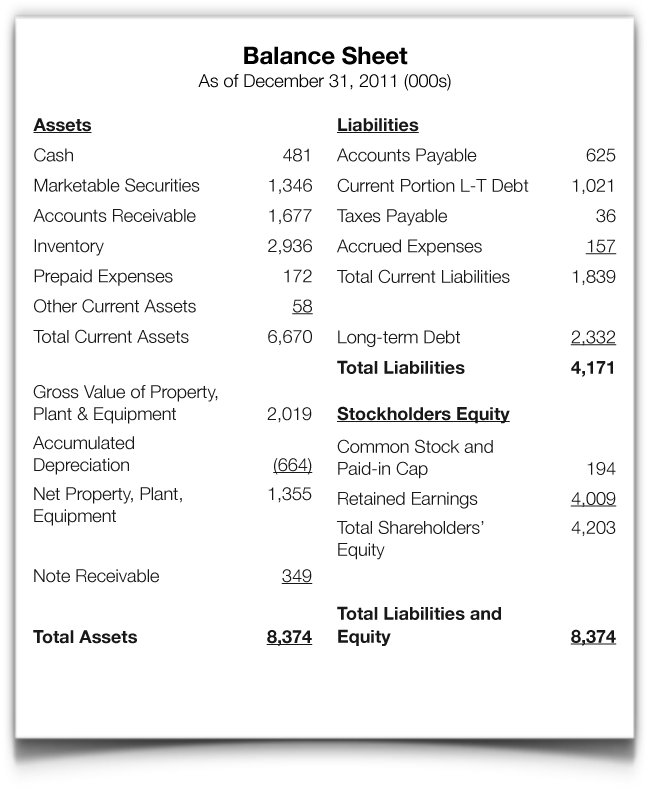

Balance Sheet Provides Insights For Debt Collection

Contact the Internal Revenue Service for further details concerning these options as well as the tax withholding implications of payments under this part.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

. Grants Grant News FY2024 Application Cycle. Business Credit Living Benefit Insurance 1 provides critical illness and disability coverages and can pay a benefit towards the outstanding balance 2 of your insured business credit products if the insured person 1 experiences a covered critical illness 1 or becomes totally disabled 1. The Small Matching Grant Panel reviewed and scored eligible FY2024 Small Matching grant applications on September 7th 2022.

Directors and their spouses or relatives are excluded employees and are not entitled to any priority retrenchment pay for the period they are a director spouse or relative of a director. Liquidation is also sometimes referred to as winding-up or dissolution although dissolution technically refers to. Requires the computation of capital in such companies to take into account any off-balance-sheet activities for purposes of meeting their capital requirements.

Will pay you the amount of the credit balance. Jennifer Heim program founder and director of the Chicago-based Detour 2 Discovery Day School has made loans to her employees for years. Fact Sheet and Certificate of Insurance Quebec only.

If we cancel your credit card we will tell you. A Sections 33-600 to 33-998 inclusive shall be so construed as to provide for a general corporate form for the conduct of lawful business with such variations and modifications from the form so provided as the interested parties may agree upon subject to the interests of the state and third parties. Any amounts left owing after these priority amounts are treated as an ordinary unsecured claim along with other unsecured creditors eg.

Enjoy the security of knowing that the amount owing on your Credit Card Account can be paid off or reduced by either a lump sum. Division of Historical Resources. A customer gives you a deposit of 50 towards the purchase of an item that is taxable at 5 GST but does not pay the balance owing and forfeits the deposit.

Deduct the amount of taxes to be withheld from the student loan repayment benefit before the balance is issued as a loan payment to the holder of the loan. Answer Yes on line 17 if the total amount reported for professional fundraising services in Part IX line 11e plus the portion of the line 6 amount attributable to professional fundraising services exceeds 15000. With effect from July 03 2014 it has been decided that any financial commitment FC exceeding USD 1 one billion or its equivalent in a financial year would require prior approval of the Reserve Bank even when the total FC of the Indian Party is within the eligible limit under the automatic route ie within 400 of the net worth as per the last audited balance.

Before filing Form 990-PF for the first time you may want to go to IRSgovEO for the. The employee had gone to a payday lender and was having difficulty with the high-interest rates. 2 The insurer will pay the amount of the outstanding credit balance to The Toronto.

Answer Yes on line 18 if the sum of the amounts reported on lines 1c and 8a of Form 990 Part VIII exceeds 15000. 1 As defined in the Certificate of Insurance. Public Works and Infrastructure Minister Patricia De Lille with her Social Development and Home Affairs counterparts as well as MAYCO members from City of Tshwane at the launch of the Salvokop Precinct Development on 29 June 2022.

Whereas the federal FFEL they are not direct loans the overwhelming majority of that 250 billion is actually held by private banks. May charge you an amount that is our reasonable estimate of the costs of closing your account. Initial Form 990-PF by former public charity.

A Unless a director complies with the applicable standards for conduct described in Section 33-31-830 a director who votes for or assents to a distribution made in violation of this chapter or the articles of incorporation is personally liable to the corporation for the amount of the distribution that exceeds what could have been distributed without violating this chapter. If appropriate we will give you the general reasons for doing so. If you are filing Form 990-PF because you no longer meet a public support test under section 509a1 and you havent previously filed Form 990-PF check Initial return of a former public charity in Item G of the Heading section on page 1 of your return.

I had an employee come to me a decade ago because she was struggling with debt Heim said. We consider you to have collected the GST equal to 5105 of the forfeited deposit. We asked Tony Xia Director of The Mortgage Agency about the pros and cons of a reverse mortgage for Australians over 60 whether they are a good idea or not and other options to consider.

As a result you have to include GST of 238 50 5105 in your net tax calculation. We will tell you if we cancel your credit card. Critical Illness coverage can pay up to 1000000 with a maximum of 500000 towards.

A copy of every balance sheet including every document required by law to be annexed thereto which is to be laid before the Company in General Meeting together with a copy of the Auditors report shall not less than twenty-one 21 days before the date of the General Meeting be sent to every Member of and every holder of debentures of. Heres what he said along with some Canstar insights based on wider research. Note to 537106a6.

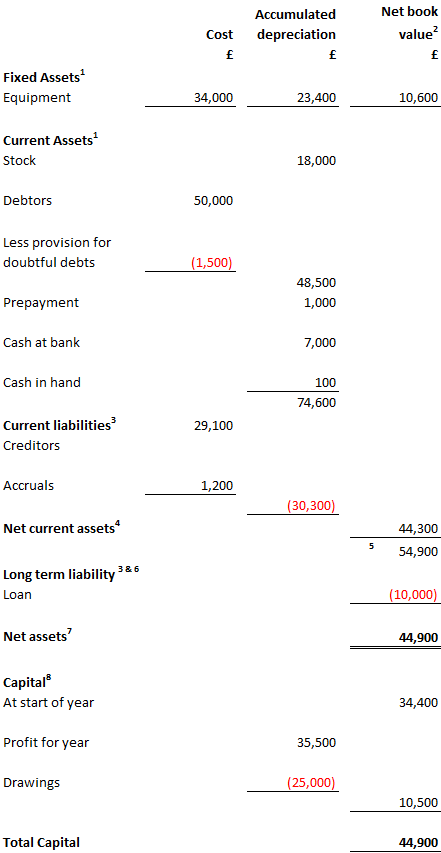

Its like erasing debt on the balance sheet.

How To Read Understand A Balance Sheet Hbs Online

Plus One Accountancy Chapter Wise Questions And Answers Chapter 8 Financial Statements I Financial Statements Ii Hssli Financial Statement Wise Chapter

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

Balance Sheet Example The Law Student Blog

Understanding Company Accounts Corporate Watch

Understanding Company Accounts Corporate Watch

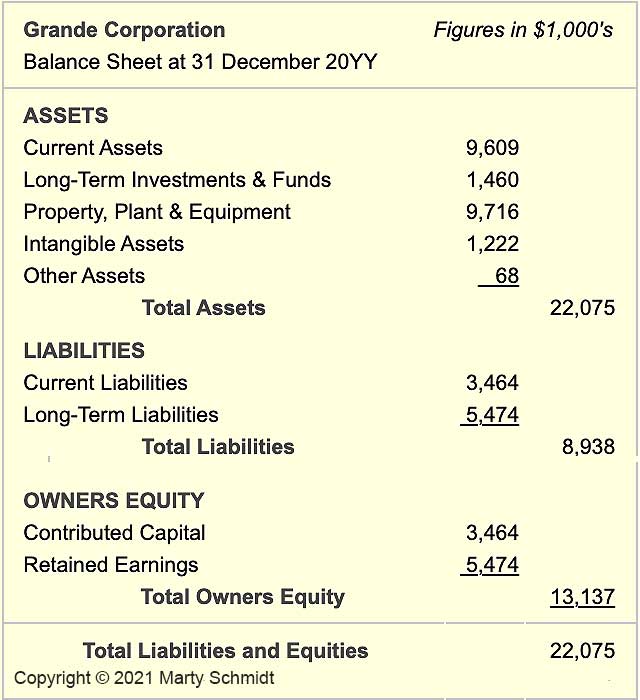

How To Create A Projected Balance Sheet Presenting Forecast Assets And Liabilities

What Is The Current Portion Of Long Term Debt Bdc Ca

Asset Liability Management Wikipedia The Free Encyclopedia Asset Liability Management Cash Flow Statement Commercial Loans

How To Make A Balance Sheet For A Small Business An Easy Way To Start Is To Download This Balance Sheet Business Template Balance Sheet Template Balance Sheet

Assets And Liabilities Worksheet Beautiful Dentrodabiblia Assets And Liabilities Worksheet Balance Sheet Template Balance Sheet Accounting

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Balance Sheet Explanation Components And Examples

Balance Sheet Explained Maslins Accountants Maslins Accountants

Owner S Equity What It Is And How To Calculate It Bench Accounting

Owners Equity Net Worth And Balance Sheet Book Value Explained

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

Financial Statements List Of Types And How To Read Them

New Balance Sheet Download Xls Xlsformat Xlstemplates Xlstemplate Check More At Https Mavensocial Balance Sheet Template Lesson Plan Templates Fact Sheet

The Balance Sheet Accounting 4 Business Studies Students